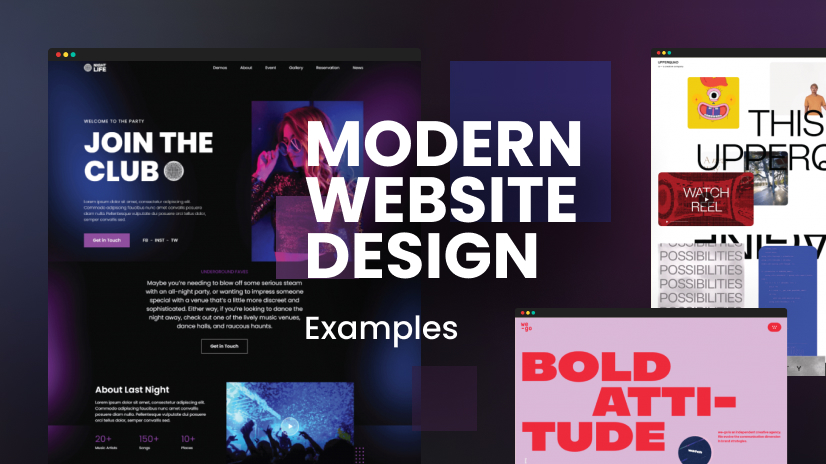

Opinion: With Bitcoin's Halving Months Away, It May Be Time to Go Risk-On

Prepare for Bitcoin Halving Risk-On strategy. Discover growth potential with expert insights. It's time to invest wisely.

As Bitcoin's next halving event approaches, excitement is mounting within the cryptocurrency community. Historically, halvings have been followed by significant price increases, and many believe that this time will be no different. This article will explore the reasons why Bitcoin's upcoming halving could be a major catalyst for a bull run, and why investors should consider increasing their exposure to cryptocurrencies.

What is a Bitcoin Halving?

A Bitcoin halving is a programmed event that occurs approximately every four years, where the reward for mining new bitcoins is cut in half. This event is designed to slow down the rate at which new bitcoins are created, and to eventually make the cryptocurrency scarce. The next halving is expected to occur in April 2024, at which point the miner reward will be reduced from 6.25 BTC to 3.125 BTC.

Why Halvings Are Significant

Halvings are significant because they reduce the supply of new crypto market prediction entering the market. This reduction in supply, combined with the ever-increasing demand for Bitcoin, is believed to be a major driver of price appreciation. In the past, Bitcoin's price has typically increased significantly in the months leading up to and following a halving event.

Why This Halving Could Be Different

There are several reasons why this upcoming halving could be even more impactful than previous halvings. First, Bitcoin is now a much more widely recognized and accepted cryptocurrency than it was in the past. This means that there is a much larger pool of potential investors who are aware of Bitcoin and who may be interested in buying it.

Second, the institutional investment landscape has changed dramatically since the last halving. In the past, institutional investors were largely absent from the crypto stock price. However, in recent years, many institutional investors have begun to allocate a portion of their portfolios to cryptocurrencies. This trend is likely to continue in the years to come, and could provide a major boost to Bitcoin's price.

Third, the global economic environment is currently very different from what it was in the past. Inflation is at its highest level in decades, and many investors are looking for safe-haven assets to protect their portfolios. Bitcoin is often seen as a safe-haven asset, and could see increased demand from investors looking to hedge against inflation.

What to Expect

It is impossible to say with certainty what will happen to Bitcoin's price in the lead-up to and following the upcoming halving. However, based on historical trends and the current market environment, it is reasonable to expect that Bitcoin's price could increase significantly. This could lead to a bull run in the overall cryptocurrency market, as investors rotate their capital into cryptocurrencies in search of higher returns.

What Investors Should Do

Investors who are considering increasing their exposure to cryptocurrencies should carefully consider their own risk tolerance and investment goals. Cryptocurrencies are a highly volatile asset class, and there is no guarantee that they will appreciate in value. However, for investors who are comfortable with taking on more risk, crypto markets news could offer the potential for significant returns.

Bitcoin's upcoming halving is a major event that could have a significant impact on the cryptocurrency market. Investors should carefully consider the potential risks and rewards of investing in cryptocurrencies before making any decisions. However, for those who are willing to take on more risk, cryptocurrencies could offer the potential for significant returns.

Bitcoin's Halving: A Potential Catalyst for a Bull Run

Bitcoin's upcoming halving is a major event that could have a significant impact on the cryptocurrency market. Investors should carefully consider the potential risks and rewards of investing in cryptocurrencies before making any decisions. However, for those who are willing to take on more risk, crypto market today could offer the potential for significant returns.

Why This Halving Could Be Different

There are several reasons why this upcoming halving could be even more impactful than previous halvings. First, Bitcoin is now a much more widely recognized and accepted cryptocurrency than it was in the past. This means that there is a much larger pool of potential investors who are aware of Bitcoin and who may be interested in buying it.

Second, the institutional investment landscape has changed dramatically since the last halving. In the past, institutional investors were largely absent from the cryptocurrency market. However, in recent years, many institutional investors have begun to allocate a portion of their portfolios to cryptocurrencies. This trend is likely to continue in the years to come, and could provide a major boost to Bitcoin's price.

Third, the global economic environment is currently very different from what it was in the past. Inflation is at its highest level in decades, and many investors are looking for safe-haven assets to protect their portfolios. Bitcoin is often seen as a safe-haven asset, and could see increased demand from investors looking to hedge against inflation.

What to Expect

It is impossible to say with certainty what will happen to Bitcoin's price in the lead-up to and following the upcoming halving. However, based on historical trends and the current market environment, it is reasonable to expect that Bitcoin's price could increase significantly. This could lead to a bull run in the overall crypto market cap, as investors rotate their capital into cryptocurrencies in search of higher returns.

What Investors Should Do

Investors who are considering increasing their exposure to cryptocurrencies should carefully consider their own risk tolerance and investment goals. Cryptocurrencies are a highly volatile asset class, and there is no guarantee that they will appreciate in value. However, for investors who are comfortable with taking on more risk, cryptocurrencies could offer the potential for significant returns.

Bitcoin's upcoming halving is a major event that could have a significant impact on the cryptocurrency market. Investors should carefully consider the potential risks and rewards of investing in cryptocurrencies before making any decisions. However, for those who are willing to take on more risk, cryptocurrencies could offer the potential for significant returns.

What's Your Reaction?