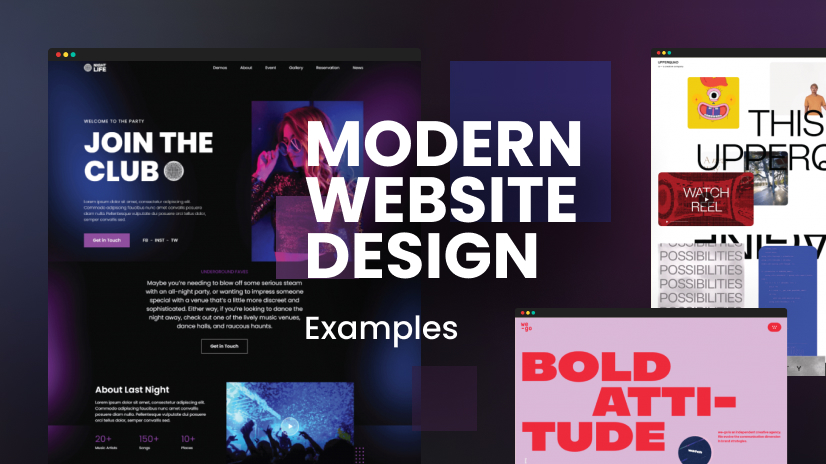

BitFuFu's $20.5M Acquisition of Oklahoma Data Center Marks Strategic Expansion in Bitcoin Mining

BitFuFu acquires a 51MW Bitcoin mining data center in Oklahoma for $20.5M, enhancing its U.S. operations. Explore market analysis, expert insights, and key Ethereum metrics.

In a significant move to bolster its North American presence, cryptocurrency mining firm BitFuFu has acquired a 51-megawatt Bitcoin mining data center in Oklahoma for $20.5 million. This strategic acquisition underscores BitFuFu's commitment to expanding its infrastructure and operational capacity in the United States.

Market Analysis

The acquisition comes at a time when the cryptocurrency mining industry is experiencing rapid growth, particularly in North America. Factors such as favorable regulatory environments, access to affordable energy sources, and technological advancements have made the U.S. an attractive hub for mining operations. BitFuFu's investment in the Oklahoma facility aligns with this trend, positioning the company to capitalize on the region's resources and regulatory support.

Expert Opinions

Industry analysts view BitFuFu's expansion as a strategic response to the increasing global demand for Bitcoin and the need for scalable mining solutions. By enhancing its infrastructure in the U.S., BitFuFu is poised to improve operational efficiency and reduce latency for North American users. This move is expected to strengthen the company's competitive edge in the global cryptocurrency mining landscape.

Ethereum Metrics Overview

While Bitcoin mining operations expand, Ethereum (ETH) continues to demonstrate robust performance in the cryptocurrency market. As of February 23, 2025, Ethereum is trading at $2,789.46, reflecting an increase of 0.03909% from the previous close. The intraday high reached $2,796.20, with a low of $2,679.35.

Key metrics for Ethereum include:

-

Active Addresses and Network Growth: Recent data indicates a rise in active Ethereum addresses and network growth, suggesting increased utility and user engagement. This uptick is a positive indicator of the network's health and adoption rate.

-

Market Value to Realized Value (MVRV) Ratio: The MVRV ratio, which compares Ethereum's market capitalization to its realized capitalization, has shown fluctuations. A higher MVRV ratio may indicate overvaluation, while a lower ratio could suggest undervaluation. Monitoring this metric provides insights into potential market corrections.

-

Top Holders: Analysis of the top 100 Ethereum addresses reveals trends in accumulation or distribution among major stakeholders. Changes in holdings by these top addresses can influence market sentiment and price movements.

What's Your Reaction?